Portfolio Overview

Keller’s Lethargic Asset Allocation (LAA) framework is a rules-based approach that aims to reduce portfolio volatility while maintaining long-term exposure to growth assets. It allocates across multiple asset classes to balance risk under varying market conditions, with minimal need for adjustment.

The strategy uses a mechanism called the Growth-Trend Indicator, which monitors economic signals. When both the trend in the S&P 500 and the unemployment rate suggest heightened risk, the model shifts exposure away from equities like QQQ and into more defensive assets such as U.S. Treasury bonds. This mechanism is designed to mitigate drawdowns during periods of market stress, based on historical analysis.

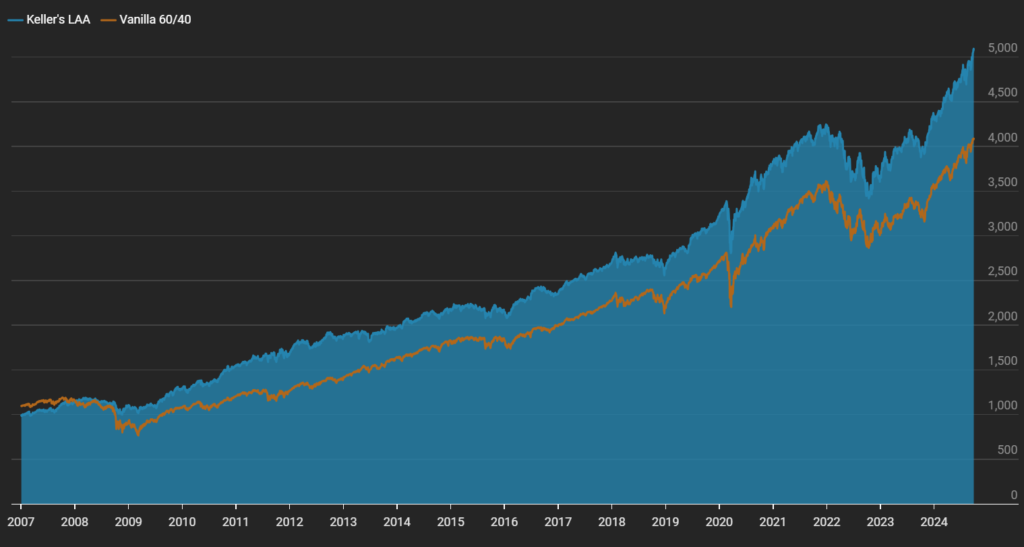

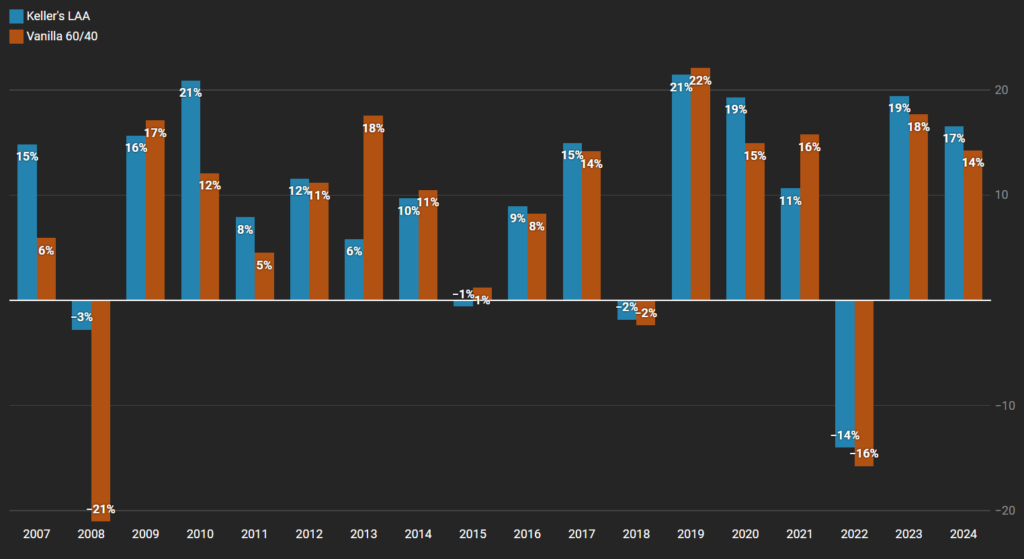

Real-Time Performance

We update the performance of Keller’s Lethargic Asset Allocation every day, so you can track how it’s doing over time. Here’s a look at the most recent data:

Key Performance Metrics

| Metric | LAA Portfolio | 60/40 Portfolio |

|---|---|---|

| Start Date(01/03/2007) | $1,000.00 | $1,000.00 |

| End Date(10/28/2024) | £5,126.26 | £3,726.92 |

| Annual Return (CAGR) | 9.66% | 7.70% |

| Annual Volatility | 9.17% | 10.07% |

| Max Drawdown | -19.48% | -35.69% |

| Sharpe Ratio | 0.89 | 0.63 |

| Martin Ratio | 2.23 | 1.01 |

Asset Allocation

The strategy uses a balanced mix of four main asset types:

- U.S. Growth Stocks (25%): Exposure to U.S. growth companies using ETF QQQ.

- US Value Stocks (25%): Exposure to U.S. large value stocks using ETF IWD.

- Bonds (25%): Intermediate-term US Treasuries add stability, as they often hold up better when stocks are down. Using ETF IEF

- Gold (25%): Gold, provides protection against inflation and adds another layer of diversification. Using ETF GLD

The equal allocation across multiple ETFs is designed to diversify exposure and limit the impact of underperformance in any one segment.

How We Implement the Lethargic Asset Allocation (LAA) Strategy

The Lethargic Asset Allocation (LAA) strategy, introduced by Wouter Keller, offers a rules-based approach to multi-asset investing. At QuantReturns, we’ve implemented a research model of this strategy based on its core principles, using publicly available ETFs and end-of-day data.

Our goal is to study how the strategy behaves over time under real market conditions—not to promote it as an investment solution.

1. Strategy Overview

The LAA model is built on a simple framework:

- 75% of the portfolio remains in a static allocation.

- 25% is adjusted tactically based on market and economic conditions.

- The result is a low-turnover strategy that aims to adapt to macro shifts without constant rebalancing.

2. Asset Allocation Structure

Our implementation distributes capital equally across four ETFs, each representing a distinct asset class:

| ETF | Asset Class | Allocation |

|---|---|---|

| QQQ | U.S. Tech Stocks (Growth) | 25% |

| IWD | U.S. Value Stocks | 25% |

| GLD | Gold | 25% |

| IEF | U.S. Intermediate Treasuries | 25% |

Under normal market conditions, QQQ serves as the growth component. However, it becomes dynamic based on our timing rule.

3. Growth-Trend Timing Overlay

The LAA model uses a two-signal rule to determine when to replace QQQ with a more defensive asset (SHY — Short-Term Treasuries):

- Economic Signal: The most recent unemployment rate is higher than its 12-month moving average.

- Market Signal: The S&P 500 index is below its 200-day simple moving average.

When both signals are triggered, the model replaces QQQ with SHY. This mechanism is designed to reduce drawdowns during major downturns, based on historical analysis.

4. Rebalancing Methodology

To maintain the intended allocations, the model rebalances twice a year (semi-annually).

Rebalancing Steps:

- Review allocations every 6 months.

- Adjust holdings back to 25% each, based on current market values.

- Maintain low turnover and cost efficiency in line with the “lethargic” philosophy.

Final Note

This implementation of LAA reflects our interpretation of the framework based on public sources. It is used strictly for research and tracking purposes at QuantReturns. This is not investment advice, and we do not recommend any strategy or portfolio for individual use.

How Do I Invest in the Keller’s LAA Portfolio?

At QuantReturns, we’ve implemented a model version of Keller’s Lethargic Asset Allocation (LAA) strategy to study its behavior under real-market conditions. We’ve automated the logic described in the original research and track its performance using end-of-day data.

This model is part of our broader research into systematic strategies and is updated regularly to reflect how the rules would operate in practice. All strategy performance is published transparently in our research library.

If you’d like to learn more about how the model works or explore the latest results, feel free to browse the strategy page or get in touch.

In Summary

Keller’s Lethargic Asset Allocation is a rules-based strategy designed to maintain a steady asset mix while responding to shifts in economic and market conditions. Its use of a Growth-Trend Indicator introduces a simple timing overlay that historically reduced drawdowns during periods of market stress. At QuantReturns, we track this model to study its long-term performance characteristics and behaviour under different market regimes.

Disclaimer

This website provides an assessment of the market and economic environment at a specific point in time. It is not intended as a forecast of future events or a guarantee of future results. The content is meant to present ideas for further research and analysis and should not be interpreted as a recommendation to invest.

This material does not provide individualized advice or recommendations for any specific reader. Forward-looking statements are subject to risks and uncertainties, and not all relevant risks related to the ideas presented may be covered. Actual results, performance, or achievements may differ materially from those expressed or implied.

The information is based on data gathered from sources we believe to be reliable. However, its accuracy is not guaranteed, it does not purport to be complete, and it should not be used as a primary basis for investment decisions.

Readers are encouraged to conduct their own due diligence and consider their individual investment objectives, risk tolerance, time horizon, tax situation, liquidity needs, and portfolio concentration. Consulting with a professional adviser is recommended to determine whether the ideas presented here are suitable for your unique circumstances.

By using the information in this article, you agree that the author and publisher are not liable for any direct or indirect losses resulting from your use of the material.